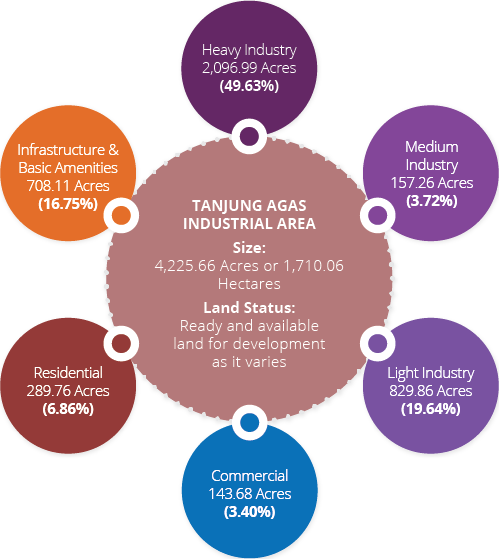

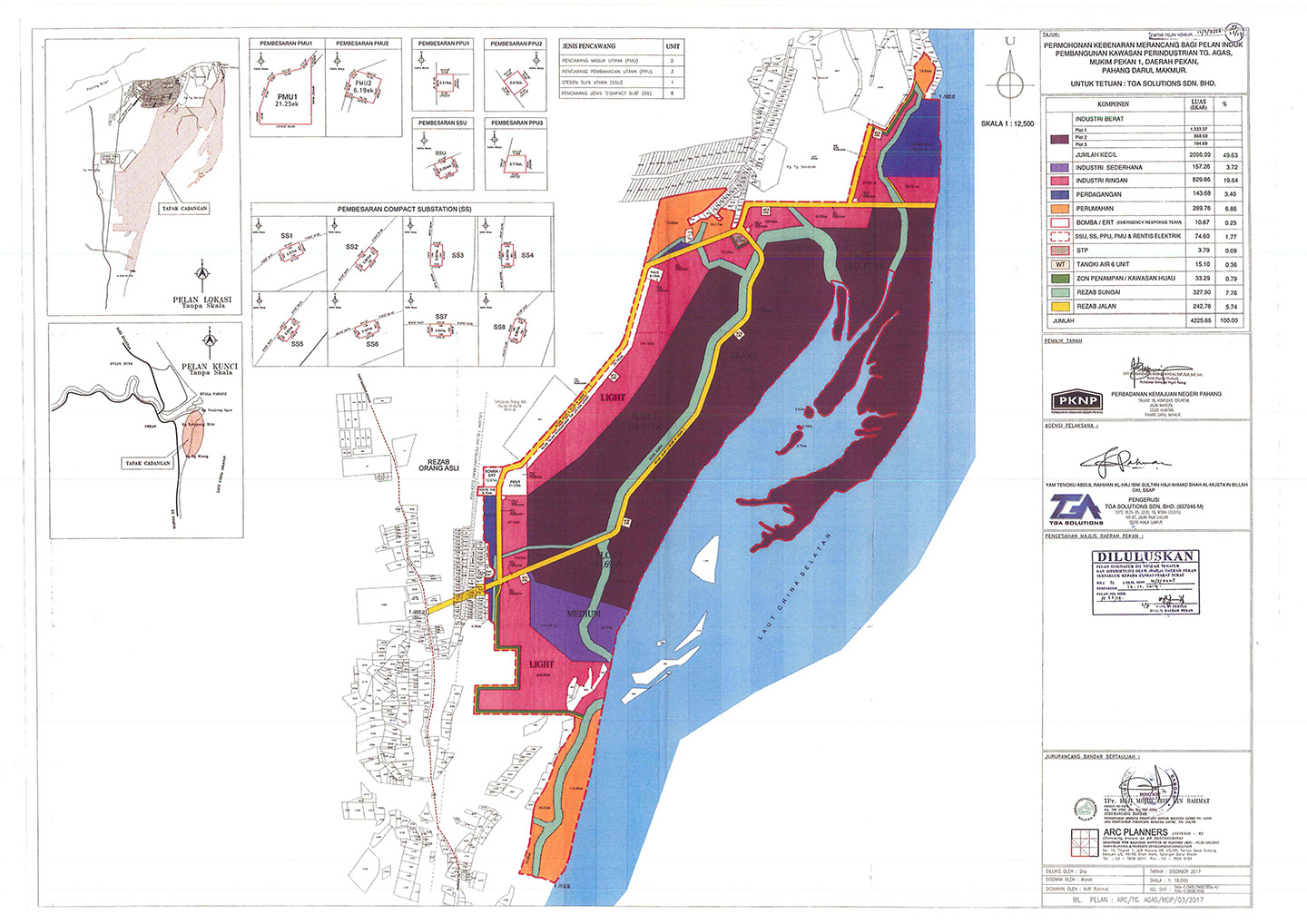

The Approved Zoning Area

Zoning Area

Approval from Pekan District Council

APPROVED IN PRINCIPLE BY MINISTRY OF FINANCE, MALAYSIA.

REF : (C) 0.217/36(16)

–15 December 2010

FEDERAL GOVERNMENT GAZETTE

REF : P.U.(B) 529

–18 October 2011

APPROVAL BY MARINE DEPARTMENT OF MALAYSIA

REF : (19) dlm IPL 2636

–20 January 2012

APPROVAL BY MINISTRY OF NATURAL RESOURCES & ENVIRONMENT

REF : AS:C 50/013/501/025 Jilid 2 (07)

–13 November 2017

(REF: SUK.PHG/BPEN.002®/8.14.001 JLD 14 (14) – 25 APRIL 2O22

APPROVAL FROM PEKAN DISTRICT COUNCIL

REF : Bil. (12)dlm.MDP 10/3/0445

–26 December 2017

Pioneer status – income tax exemption of 70% to 100% of statutory income for 5 to 10 years.

Investment tax allowance – an allowance of 60% on its qualifying capital expenditure (factory, plant, machinery or other equipment used for the approved project) incurred within five years from the date the first qualifying capital expenditure is incurred.